On February 28, 2025, an educational webinar on “Taxation of

the Digital Economy” took place, focusing on current challenges and solutions

in the field of international taxation of digital businesses.The webinar was led by Raffaele Petruzzi, Director of the WU

Transfer Pricing Center at the Institute for Austrian and International Tax

Law, Vienna University of Economics and Business.

The digital economy is reshaping the world,

and tax regulations must keep up with these changes. How can multinational

companies be effectively taxed while preventing tax avoidance? These were the key

questions discussed during the webinar!

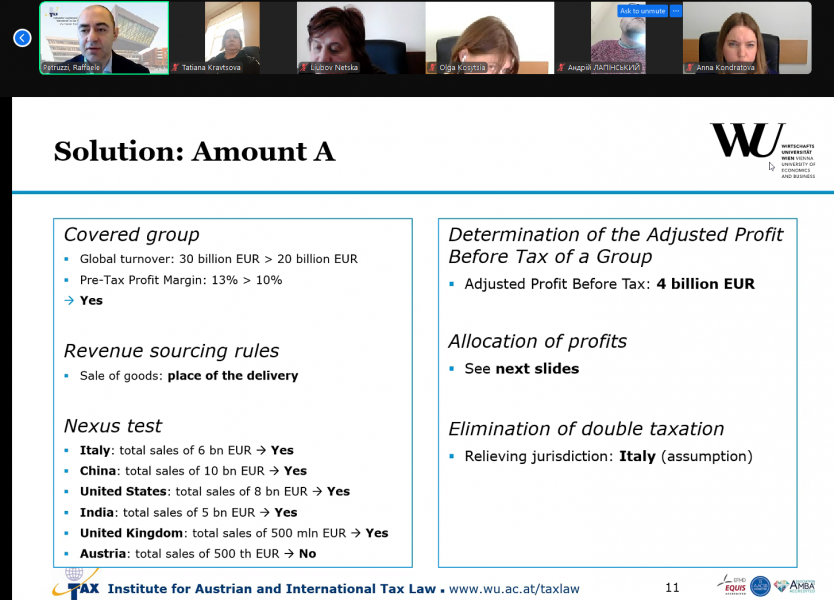

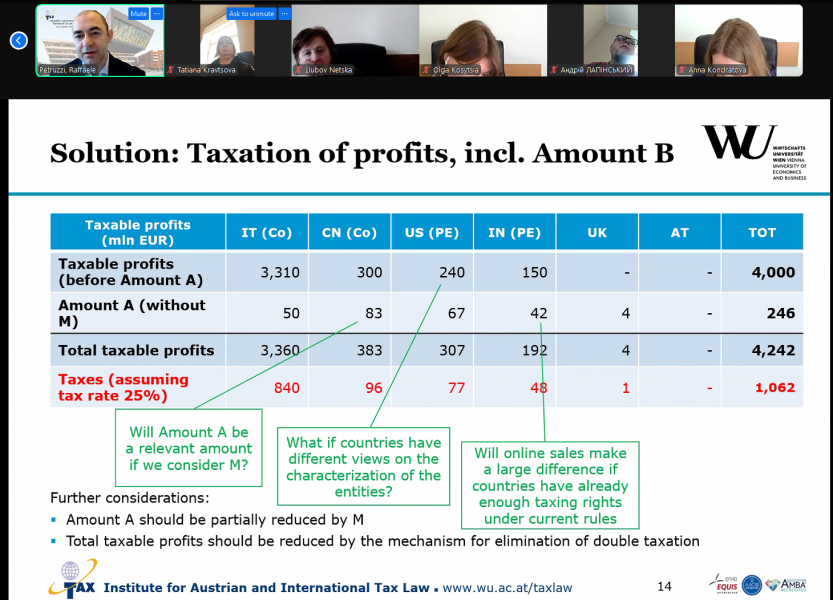

Participants explored the key approaches to digital business

taxation and global initiatives addressing these issues. The discussion covered virtual permanent establishments,

digital services taxes, and mechanisms to eliminate double taxation. Special attention was given to the OECD approach to

determining tax obligations for digital companies.

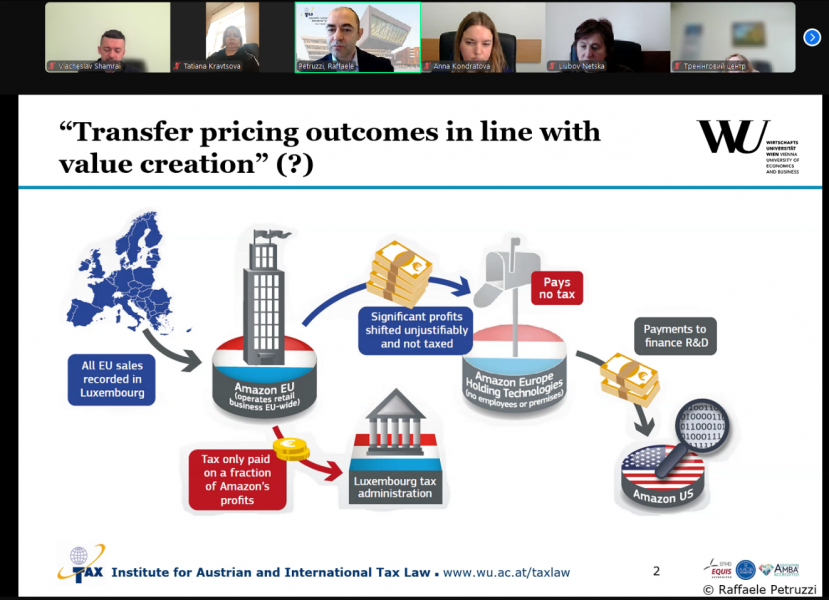

The speaker provided an in-depth analysis of transfer

pricing and profit allocation in the digital economy. The event brought together tax law professionals,

economists, and representatives of state authorities actively working to

improve the tax system in the digital age.

Simultaneous interpretation was provided with the support of

the EU project “Association4U”, making the webinar accessible to a broader

audience.

We sincerely thank all participants for their insightful

questions and engaging discussions, and we extend our gratitude to the lecturer

for his thorough analysis, expert advice, and captivating presentation! We look

forward to seeing you at our future educational events!

More posts by topic

“News”

12 December 2025 09:00

11 December 2025 09:00

09 December 2025 09:00

08 December 2025 09:00

05 December 2025 09:00

04 December 2025 09:00

03 December 2025 15:00

27 November 2025 09:00

26 November 2025 09:30

21 November 2025 15:30